Filed by the Registrant ☒ | | | Filed by a Party other than the Registrant ☐ |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

☒ | No fee required. | |||||

☐ |

☐ | Fee computed on table | |||||

6, 2024

Sincerely,  Michael J. Sacks | |||

| |||

Chief Executive Officer and Chairman |

2

3

6, 2024

4

5

6

7

Proposal | | | Votes required | | | Effect of Votes Withheld / Abstentions and Broker Non-Votes |

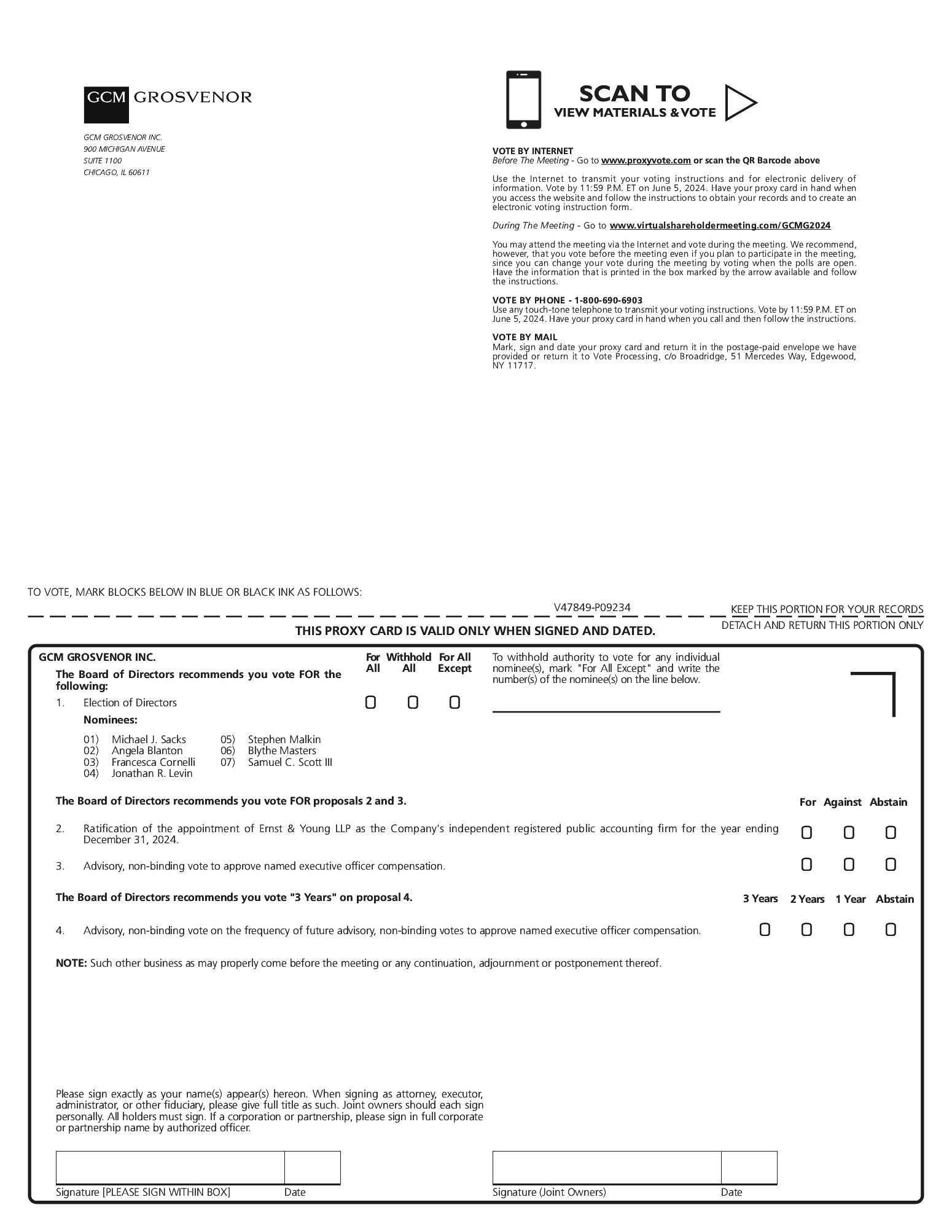

Proposal 1: Election of Directors | | | The plurality of the votes cast. This means that the seven (7) nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. | | | Votes withheld and broker non-votes will have no effect. |

| | | | | |||

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | | | The affirmative vote of the holders of a majority of the votes cast. | | | Abstentions and broker non-votes will have no effect. We do not expect any broker non-votes on this proposal. |

| | | | | |||

| Proposal 3: Approval, on an advisory (non-binding) basis, of the compensation of our named executive officers (“say-on-pay”) | | | The affirmative vote of the holders of a majority of the votes cast. | | | Abstentions and broker non-votes will have no effect. |

| Proposal | | | Votes required | | | Effect of Votes Withheld / Abstentions and Broker Non-Votes |

| Proposal 4: Approval, on an advisory (non-binding) basis, of the frequency of future advisory votes on the compensation of our named executive officers (“say-on-frequency”) | | | The affirmative vote of the holders of a majority of the votes cast. To the extent that no alternative receives a majority of the votes cast, the Board will consider the alternative receiving the greatest number of votes (once every three years, once every two years or once every year) to be the frequency recommended by our shareholders. | | | Abstentions and broker non-votes will have no effect. |

9

|

Name | | | Age | | | Position with the Company |

Michael J. Sacks | | | | | Chairman of the Board and Chief Executive Officer | |

Jonathan R. Levin | | | | | President and Director | |

Angela Blanton | | | | | Director | |

Francesca Cornelli | | | | | Director | |

Stephen Malkin | | | | | Director | |

Blythe Masters | | | | | Director | |

Samuel C. Scott III | | | | | Lead Independent Director |

12

| Board Diversity Matrix (As of April 25, 2024) | ||||||||||||

| Total Number of Directors | | | 7 | |||||||||

| | | Female | | | Male | | | Non-Binary | | | Did Not Disclose Gender | |

| Part I: Gender Identity | ||||||||||||

| Directors | | | 3 | | | 4 | | | 0 | | | 0 |

| Part II: Demographic Background | ||||||||||||

| African American or Black | | | 1 | | | 1 | | | 0 | | | 0 |

| Alaskan Native or Native American | | | 0 | | | 0 | | | 0 | | | 0 |

| Asian | | | 0 | | | 0 | | | 0 | | | 0 |

| Hispanic or Latinx | | | 0 | | | 0 | | | 0 | | | 0 |

| Native Hawaiian or Pacific Islander | | | 0 | | | 0 | | | 0 | | | 0 |

| White | | | 2 | | | 3 | | | 0 | | | 0 |

| Two or More Races or Ethnicities | | | 0 | | | 0 | | | 0 | | | 0 |

| LGBTQ+ | | | 0 | |||||||||

| Did Not Disclose Demographic Background | | | 0 | |||||||||

| | | The Board unanimously recommends a vote FOR the election of each of the above director nominees. |

| | | Year Ended December 31, | ||||

| Fee Category | | | 2023 | | | 2022 |

Audit Fees(1) | | | $2,053 | | | $1,140 |

Audit-Related Fees(2) | | | 297 | | | 591 |

Tax Fees(3) | | | 1,579 | | | 1,375 |

All Other Fees(4) | | | 985 | | | 471 |

| Total Fees | | | $ 4,914 | | | $3,577 |

| (1) | Audit fees consist of fees for the audit of our consolidated financial statements, the review of the interim financial statements included in our quarterly reports on Form 10-Q, and other professional services provided in connection with statutory and regulatory filings or engagements. |

| (2) | Audit-related fees consist of other audit and attest services not required by statute or regulation. |

| (3) | Tax fees consist of fees for tax-related services, including tax compliance, tax planning and advisory services. Fees for tax compliance were $1,091 and $1,183 for the fiscal years ended December 31, 2023 and 2022, respectively. |

| (4) | All other fees consist of due diligence services related to contemplated transactions. |

| | | The Board of Directors unanimously recommends a vote FOR the Ratification of the Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2024. |

16

17

Fee Category | | | 2020 | | | 2019 |

Audit Fees1 | | | $1,068 | | | $635 |

Audit-Related Fees2 | | | $2,995 | | | $184 |

Tax Fees3 | | | $1,605 | | | $825 |

All Other Fees | | | — | | | — |

Total Fees | | | $5,668 | | | $1,644 |

18

| Name | | | Age | | | Position with the Company |

Michael J. Sacks(1) | | | 61 | | | Chairman of the Board and Chief Executive Officer |

Pamela Bentley(2) | | | 52 | | | Chief Financial Officer |

Jonathan R. Levin(3) | | | 42 | | | President and Director |

Frederick E. Pollock(4) | | | 44 | | | Chief Investment Officer |

Sandra Hurse(5) | | | 58 | | | Chief Human Resources Officer |

| (1) | See biography on page 10 of this proxy statement. |

| (2) | Ms. Bentley serves as our Chief Financial Officer and is a member of the firm’s Operations Committee. Ms. Bentley joined GCM Grosvenor as Managing Director of Finance in October 2020 and became Chief Financial Officer in January 2021. She is responsible for managing the financial functions of the firm including overseeing activities related to corporate and fund accounting, treasury and cash management, financial planning and reporting, tax, and operational due diligence while also playing a vital role in the firm’s strategic initiatives. Prior to joining GCM Grosvenor, Ms. Bentley spent 15 years with The Carlyle Group, a publicly traded global investment firm, where her most recent role was Chief Accounting Officer and Managing Director. Previously, she was a Vice President of Finance and Investor Relations at Transaction Network Services, Inc. and a Senior Manager at Arthur Andersen LLP. Ms. Bentley received her Bachelor of Business Administration from the University of Michigan’s Ross School of Business. She is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants. Ms. Bentley is a member of and Immediate Past Chair of the Board of Directors of Junior Achievement of Greater Washington, and is also a member of the Board of Directors of Junior Achievement USA. |

| (3) | See biography on page 11 of this proxy statement. |

| (4) | Mr. Pollock serves as our Chief Investment Officer. Mr. Pollock joined GCM Grosvenor in 2015 and became Chief Investment Officer in 2019. He is responsible for managing all investment-related activities for the firm. He also serves as Head of GCM Grosvenor’s Strategic Investments Group and on all of GCM Grosvenor’s Investment Committees, the Diversity, Equity and Inclusion Committee and the Sustainability Committee. Prior to joining GCM Grosvenor, Mr. Pollock had various roles at Morgan Stanley from 2006 to 2015, most recently within its merchant banking division, specializing in infrastructure investing, with responsibility for deal sourcing, due diligence, and management as a board member of various portfolio companies. Mr. Pollock helped form the infrastructure investment group at Morgan Stanley and to structure and raise capital for its initial funds. Prior to joining Morgan Stanley, Mr. Pollock worked at Deutsche Bank, where he made investments for the firm and on behalf of clients. He received his Bachelor of Science summa cum laude in Economics from the University of Nevada and his Juris Doctor magna cum laude from Harvard Law School. |

| (5) | Ms. Hurse serves as our Chief Human Resources Officer. Ms. Hurse joined GCM Grosvenor as Chief Human Resources Officer in 2018. She is responsible for the development and execution of the firm people strategy and leads the firm’s real estate and facilities efforts. She also serves on the Sustainability Committee and the Diversity, Equity and Inclusion Committee. Prior to joining GCM Grosvenor, Ms. Hurse held various positions at Bank of America from 2013 to 2018, most recently serving as Global Head of Human Resources for Corporate and Investment Banking. Previously, Ms. Hurse also held leadership roles in Talent Management and Talent Acquisition at Goldman Sachs & Co. from 2006 to 2013 and J.P. Morgan Chase & Co. from 1998 to 2006. She received a Bachelor of Business Administration in Finance from Bernard M. Baruch College and a Master of Business Administration in Marketing from the University of Michigan. Ms. Hurse has served on the Board of Angi (NASDAQ: ANGI) since November 2021, including on its Executive Compensation and Compensation Committees. Ms. Hurse serves as a Corporate Board Member for the Harlem School of the Arts, the Council for Urban Professionals and the Thurgood Marshall College Fund, where she is a member of the finance committee. |

Name and Principal Position | | | Year | | | Salary ($) | | | Bonus ($) | | | All Other Compensation ($) | | | Total ($) |

Michael J. Sacks Chief Executive Officer and Chairman | | | 2020 | | | 3,700,000 | | | — | | | 282,540(1) | | | 3,982,540 |

| | 2019 | | | 3,585,000 | | | — | | | 2,776,545 | | | 6,361,545 | ||

Jonathan R. Levin President | | | 2020 | | | 500,000 | | | 861,957(2) | | | 25,097,954(3) | | | 26,459,911 |

| | 2019 | | | 500,000 | | | 1,600,000 | | | 7,183,700 | | | 9,283,700 | ||

Sandra Hurse Managing Director, Chief Human Resources Officer | | | 2020 | | | 500,000 | | | 1,702,147(4) | | | 757,511(5) | | | 2,959,658 |

| | 2019 | | | 500,000 | | | 860,000 | | | 47,081 | | | 1,407,081 | ||

Francis Idehen Managing Director, Chief Operating Officer | | | 2020 | | | 500,000 | | | 2,393,577(6) | | | 1,105,266(7) | | | 3,998,843 |

| | 2019 | | | 500,000 | | | 1,283,333 | | | 99,695 | | | 1,883,028 | ||

Frederick Pollock Managing Director, Chief Investment Officer | | | 2020 | | | 500,000 | | | 1,687,500(8) | | | 11,650,523(9) | | | 13,838,023 |

| | 2019 | | | 500,000 | | | 1,533,333 | | | 2,718,810 | | | 4,752,143 |

In order to attract, retain, reward and motivate talented executives, including our NEOs, our executive compensation program consists of the following components: